During Gordon Brown's tenure as Chancellor and Prime Minister, there's one (and probably the only) decision he made with which I'm forever grateful; Brown's veto over Blair regarding the UK's entry into the Eurozone.

During Gordon Brown's tenure as Chancellor and Prime Minister, there's one (and probably the only) decision he made with which I'm forever grateful; Brown's veto over Blair regarding the UK's entry into the Eurozone.This decision was not made for what Brown thought was the best for the country, but for personal political reasons. It could, however, be the one decision that helps provide him with a positive legacy.

Brown had previously supported Britain's entry into the ERM in the early 90s under John Major's Tory government:

"We can fight the speculators if we join the ERM."and had supported Britain's entry into a single currency before the 1997 election. Brown's change of mind was due to a number of factors; the power struggle between the Treasury and Number 10 (Brown did not want Blair to be credited with such an historic decision), being a control freak he would not give up UK financial sovereignty (his power) lightly, and more importantly the influence of his adviser Ed Balls.

Ed Balls, a steadfast opponent of Britain's membership of the Euro, wrote the five tests, according to Brown's unofficial biographer, in a taxi:

Initially drafted on the back of an envelope while Brown was traveling with Balls in the back of a taxi in New York...

Despite the UK's disastrous public finances that one decision has immunised the UK from further unnecessary financial pain, as 2010 heralds a full-blown debt crisis within the Eurozone that threatens the entire structure.

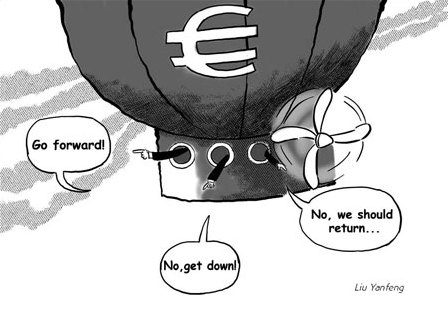

As noted in a previous post the Euro has a fundamental contradiction at its heart, and the true test and measure of success, of the Euro was always going to be whether it would survive its first recession intact. That is looking increasingly unlikely.

The European Commission last month expressed alarm over the Eurozone's mounting debt crisis, seeing it as a threat to efforts aimed at pulling the zone out of its first recession.

In order to try to pull the 16-nation zone out of recession borrowing has been heavy, and debt levels are set to smash a whacking great hole in the ceiling set by the European Union in its Stability and Growth Pact. The European Commission has warned (my emphasis):

"Soaring budget deficits, low growth and banking sector support are feeding into significantly higher public debt levels..."and thus:

"the public finances of a given country may be unsustainable if the initial structural primary balance, the projected interest payments and economic growth imply an ever increasing debt ratio."Peter Oborne picks up on the Euro crisis in yesterday's Observer:

The imposition of the euro, and the rigid economic policy a single currency implies, is having socially catastrophic effects across much of Europe on a scale that dwarfs Britain's suffering in the 1990s.

Consider the facts. In Spain, unemployment has already reached a gut-wrenching 19.3%. But unemployment for those between 16-24 is a catastrophic 42%. In Greece, youth unemployment is 25%, in Ireland 28.4% and Italy 26.9%. Marginal eurozone countries such as Greece, Spain and Ireland are not just in recession. They are in depression – and so long as they remain inside the euro there is no exit.

Although half of the 16 Eurozone nations are at high risk of becoming unsustainable, the biggest problem is Greece. The Greek government is desperately trying to seek a deal within its parliament for a plan to bring down public spending, but without triggering similar social unrest seen in the country's streets in 2008 and 2009.

The Greek problem is compounded by the mixed messages from Brussels. Athens has been told to get itself into shape without outside help, Europe’s Economic and Monetary Affairs Commissioner Joaquín Almunia indicated that Greece could not rely on the Eurozone to come to its rescue.

It is, however, unlikely that the Eurozone would allow one of its own to go into default - the project is far too important to allow Greece to default. As Oborne notes:

There is a universal belief among the European political and economic elite that the euro will continue.

The European Commission has boasted that it stands ready to help and so, much like in the UK, the political elite will continue regardless of the consequences or the will of the people.

Unfortunately the German public ain't gonna like that. They were persuaded to give up their deutsche mark on the assurance that, if they went into the Euro, there was no chance they would be called on to bail-out other Eurozone countries. This is reflected in the clear ‘no bailout’ promise of the Maastricht Treaty, now Art. 103 of the Lisbon Treaty. The EU looks set to bend and break its own rules at will.

When a poll was done earlier this year regarding the possibility of bailing out Ireland, over 70% of Germans were opposed. If Greece is bailed out, Germany would pick up a quarter of the tab.

This willful disregard for the citizens in the EU cannot continue forever. When taxpayers are arrogantly disregarded, when high levels of young people are without jobs and when people are left without political solutions then they take the only option available to them. Something is inevitable going to snap, and snap soon.

The riot phase is in the post that's for sure.

No comments:

Post a Comment